Institutional Deposit

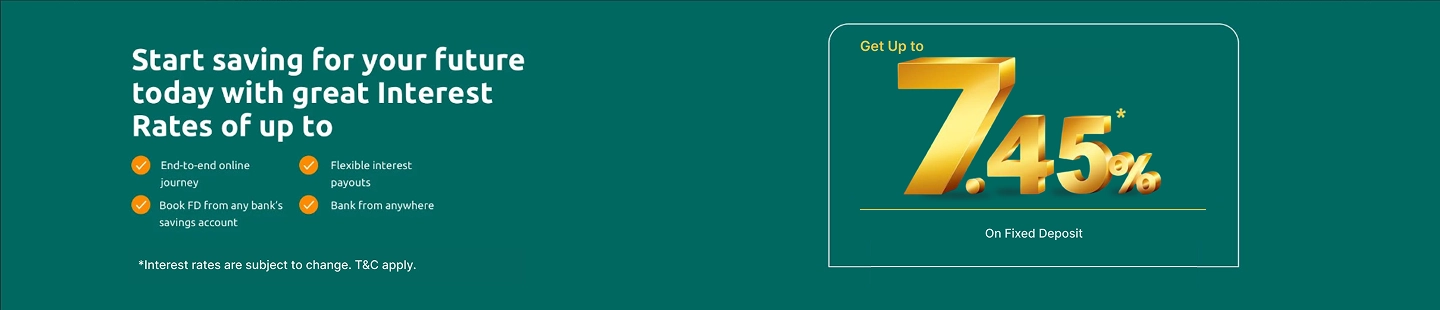

Ujjivan SFB Institutional Deposit is meticulously designed for trusts, associations, societies and clubs (TASC). Enjoy guaranteed returns of up to 7.45%* p.a., multiple interest payout options, easy account opening process and more with our TASC Deposit.

Key Features of Term Deposit for Institutional Clients

Minimum permissible deposit amount of ₹1,000 and maximum of ₹1 crore through Business Net Banking.

Book the FD through any bank’s savings account

Can be opened at any bank outlet located across 26 states and Union Territories

Premature closure is allowed

Key Features of Term Deposit for Institutional Clients

Minimum permissible deposit amount of ₹1,000 and maximum of ₹1 crore through Business Net Banking.

Book the FD through any bank’s savings account

Can be opened at any bank outlet located across 26 states and Union Territories

Premature closure is allowed

Top Benefits of Term Deposit for Institutional Clients

FD Calculator

Min ₹1000

Max ₹2.99Cr

Investment Summary

Invested Amount

₹ 1,000

Interest Earned

₹10,126

Interest Per Quarter

Interest Per Month

Maturity Value*

₹90,126

( Interest rates are indicative and for calculation only. Interest may be subject to TDS recovery and maturity amount may vary due to TDS impact )

How to Open Term Deposit Account for Institutions

Want to invest in Ujjivan SFB Institutional Term Deposit? Here are the steps that you have to follow -

*Customer should have Business Net Banking access and has to opt for online Term deposit facility to open the account.

For further assistance, you can call our 24*7 customer support or visit your nearest branch.

Ujjivan SFB Institutional Term Deposit Account Interest Rates

Below mentioned are the Interest Rates with effective from 05th Aug 2025

| Tenure | Interest Rate |

|---|---|

| 7 days to 29 days | 3.50% |

| 30 days to 89 days | 4.15% |

| 90 days to 179 days | 4.65% |

| 180 days | 6.00% |

| 6 months to < 12 months | 5.50% |

| 12 months to < 24 months | 7.25% |

| 24 months | 7.45% |

| 24 months 1 day to 990 days | 7.25% |

| 991 days to 60 months | 7.20% |

| 60 months 1 day to 120 months | 6.50% |

You can find additional disclosures here.

#Ujjivanblogs

Latest Blogs

Catch up on the latest blog updates from your trusted bank!

How Recurring Deposits Help You Build a Savings Habit

Saving money sounds easy, until you try to do it every month.

Fixed Deposits vs Sovereign Gold Bonds (SGB): Which Is the Better Investment?

In today’s uncertain economic climate, conservative and low-risk investment options continue to dominate the choices

FD vs SIP: Not a Race, But a Financial Match

We often treat money like a race — chasing returns, tracking trends, comparing who’s earning more from what.

FAQs

1. What is the Institutional Term Deposit Account?

Institutional Deposit is a term deposit account catering to trusts, associations, societies and clubs (TASC). Select the tenure of your choice ranging from 7 days to 10 years and earn big with interest rates as high as 7.45%* p.a.

2. What is the minimum deposit tenure for Ujjivan SFB Institutional Deposit?

The minimum deposit tenure for Ujjivan SFB’s Institutional Deposit account is 7 days and the maximum period is 10 years.

3. Can I make premature withdrawals from the Institutional Deposits Account?

Yes, premature closure and partial withdrawal facilities are allowed.

4. When can I receive the interest earned on my deposit under the Institutional Deposit account?

If you select the non-cumulative interest payment option, you can receive the interest monthly, quarterly, half-yearly and annually. If you pick a cumulative deposit account, the interest is paid at maturity in a lump sum amount.

5. What are the customer care details for Ujjivan SFB’s Institutional Deposit Account?

If you want to connect with Ujjivan Small Finance Bank's customer care, you can call the toll-free number 1800 208 2121 or visit the nearest branch or use the 24*7 phone banking facility.

6. Can I open the Institutional Deposit Account online?

Yes, you can apply for the Institutional Deposit Account online and enjoy a thoroughly end-to-end online journey.