World of

Ujjivan Small Finance Bank

WE ARE COMMITTED TO EMPOWERING THE MASSES OF INDIA, ESPECIALLY THOSE UN-SERVED AND THE UNDER-SERVED, BY ENHANCING THEIR ACCESS TO ESSENTIAL BANKING AND FINANCIAL SERVICES. OUR GOAL IS TO PLAY A CRUCIAL ROLE IN ADVANCING FINANCIAL AND DIGITAL INCLUSION THROUGHOUT THE NATION, ENSURING THAT ALL INDIVIDUALS HAVE OPPORTUNITIES FOR ECONOMIC GROWTH. THROUGH THIS COMMITMENT, WE STRIVE TO CONTRIBUTE TO THE NATION'S JOURNEY TOWARDS PROSPERITY AND SHARED GROWTH.

MEASURING

OUR

SUSTAINABLE

GROWTH

CONSISTENCY SERVES AS THE BEDROCK OF OUR STRONG PERFORMANCE, PROVIDING A RELIABLE FOUNDATION FOR ASSESSING OUR PROGRESS AND IMPACT. THIS CHAPTER DELVES INTO THE METRICS THAT ILLUSTRATE OUR COMMITMENT TO SUSTAINABLE GROWTH AND FINANCIAL STABILITY.

₹6,464 Crores

Total Income

36% YoY

₹1,917 Crores

Pre-Provision Operating Profit

29% YoY

₹1,281 Crores

PAT

17% YoY

₹6.65

Earnings Per Share

₹40,422 Crores

Balance Sheet Size

21% YoY

₹23,389 Crores

Disbursements

17% YoY

₹29,780 Crores

Gross Loan Book

24% YoY

₹31,462 Crores

Total Deposits

23% YoY

₹13,750 Crores

Retail Term Deposit

36% YoY

₹3,409 Crores

Net Interest Income

26% YoY

3.5%

Return on Assets

26.1%

Return on Equity

9.1%

Net Interest Margin

54%

Cost Income Ratio

87%

Provision Coverage Ratio

24.7%

Capital Adequacy Ratio

2.1%

Gross NPA

0.3%

Net NPA

BPS 23

0.58%

Credit Cost

BPS 52

MAKING

STEADY

STRIDES

99%

COLLECTION EFFICIENCY (Upto 1 EMI)

9.1 Lakhs

NEW CUSTOMERS ADDED

10,400

LEADS GENERATED PER MONTH (PHONE BANKING)

₹ 31,462 Crores

REMARKABLE MILESTONE IN OUR DEPOSITS

123

NEW BRANCHES ADDED IN OUR NETWORK DURING FY 2023-24

₹ 3,554 Crores

RAISED FROM IBPC

100%

OFFICES EQUIPPED WITH ENERGY EFFICIENT LIGHTING

2.3

EMISSION INTENSITY (TONNES CO2 EQUIVALENT PER CRORE TURNOVER)

1.2 MT

OF REFURBISHED ELECTRONIC DEVICES CONTRIBUTED FOR EDUCATIONAL PURPOSES

Top 25

‘INDIA'S BEST WORKPLACESTM’ IN BFSI INDUSTRY 2023

Top 50

‘INDIA'S BEST WORKPLACESTM’ FOR CULTURE AND INNOVATION 2023

Top 100

‘INDIA'S BEST WORKPLACESTM’ FOR WOMEN 2023 (LARGE)

Top 50

‘GREAT PLACE TO WORKTM’ IN GENERAL CATEGORY

2,507

NEW WOMEN EMPLOYEES HIRED (DOUBLE FOLD INCREASE FROM FY 2022-23) OUT OF WHICH 349 WOMEN WERE UNDER ‘UNPAUSE INITIATIVE’

20

DIFFERENTLY ABLED EMPLOYEES AS ON MARCH 31, 2024

₹6.34 Crores

CSR EXPENDITURE

2.4 Lakhs+

TOTAL BENEFICIARIES

50,000+

WOMEN EMPOWERED

40+ Years

AVERAGE EXPERIENCE OF THE BOARD MEMBERS

ISO 27001:2022

CERTIFICATION ON INFORMATION SECURITY MANAGEMENT SYSTEM

Disclosure

OF BRSR, SUSTAINABILITY & TCFD REPORTS

UJJIVAN SMALL FINANCE

BANK AT A GLANCE

UJJIVAN SMALL FINANCE BANK LIMITED (‘UJJIVAN SFB’ OR ‘WE’ OR ‘THE BANK’) IS NOT JUST ANOTHER BANK; WE ARE THE PULSE OF FINANCIAL EMPOWERMENT FOR THE UN-SERVED AND THE UNDER-SERVED IN INDIA. POSITIONED AS A LEADING SMALL FINANCE BANK, OUR COMMITMENT LIES IN OFFERING COMPREHENSIVE FINANCIAL SOLUTIONS AND DIGITAL BANKING ACCESS TO ALL.

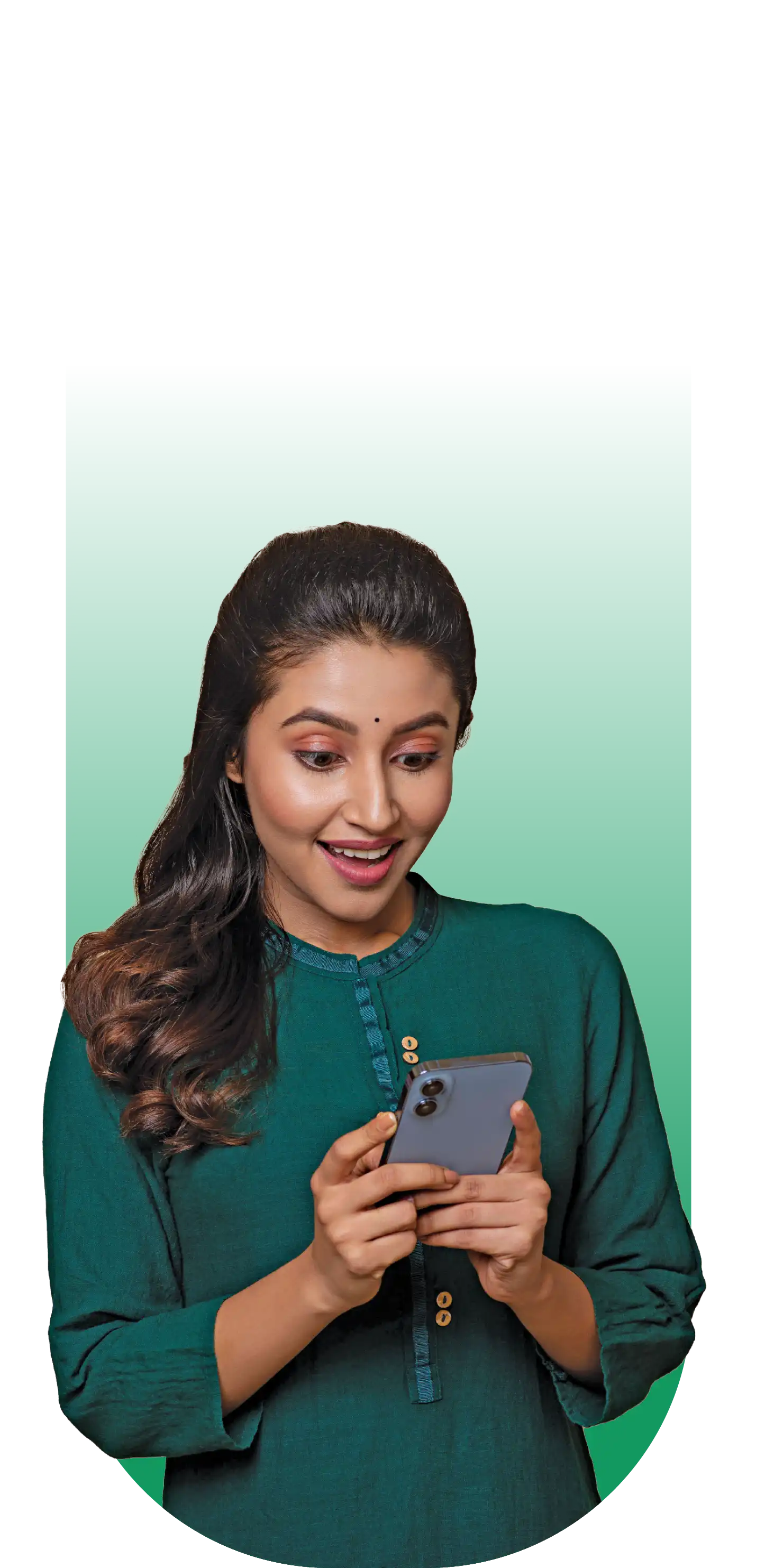

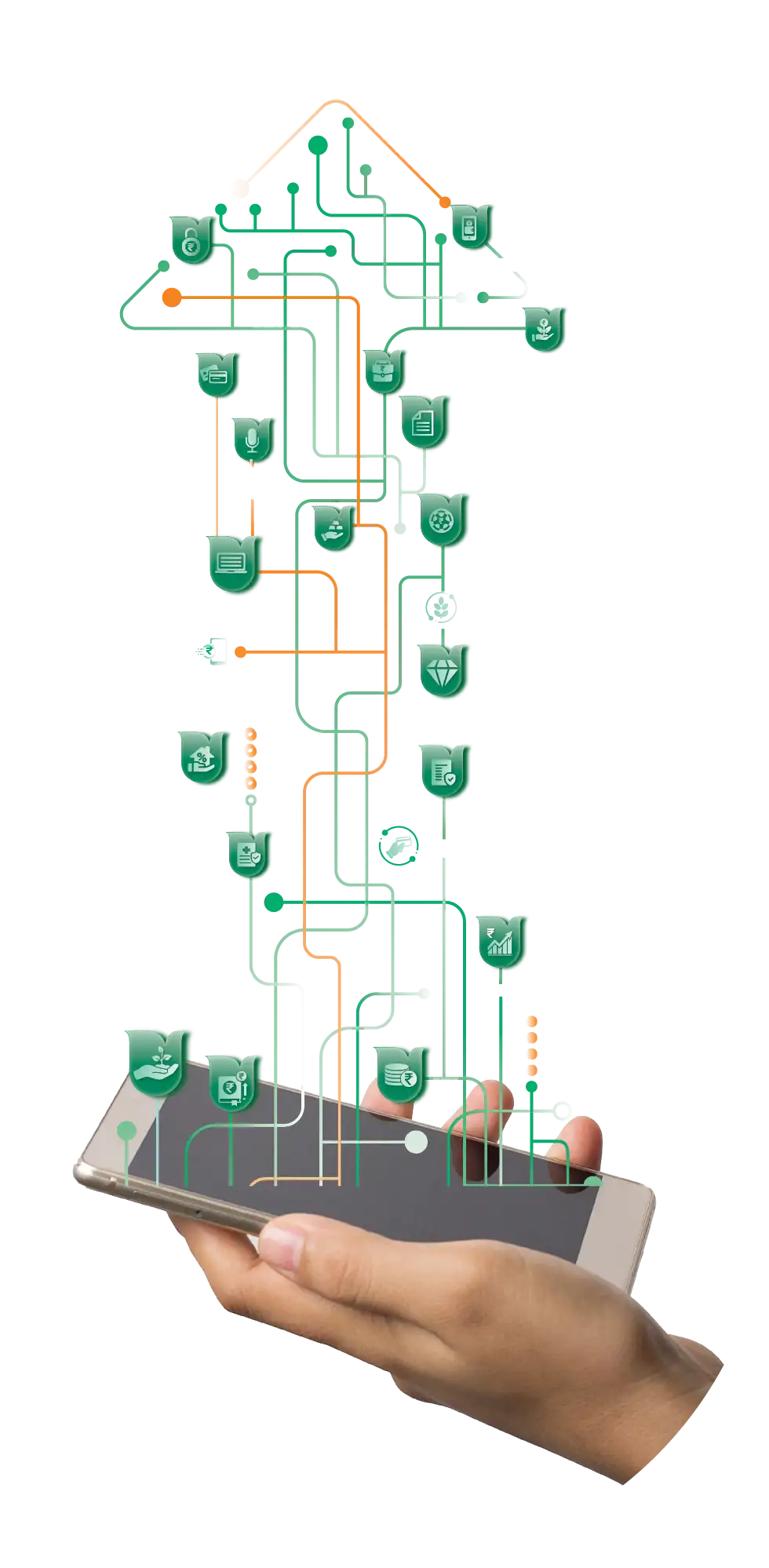

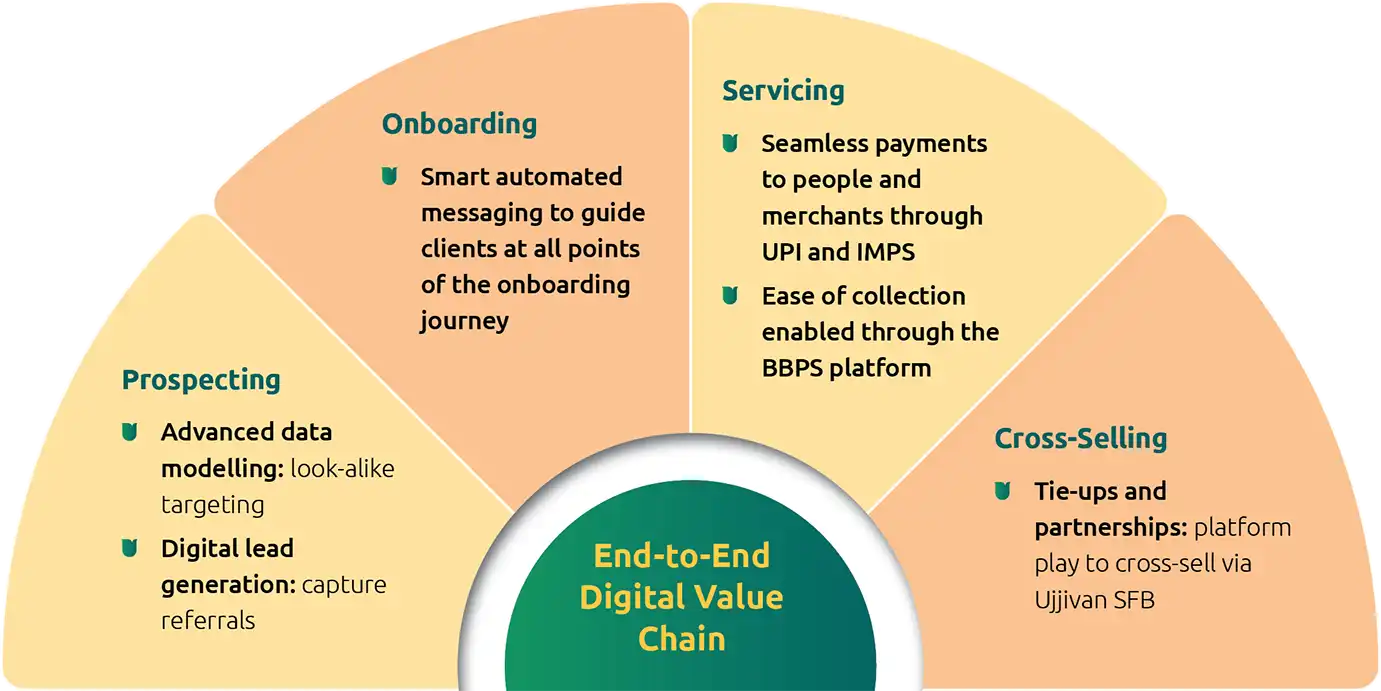

At Ujjivan SFB, we don't just bank; we innovate. With technology as our cornerstone, we've built a robust digital ecosystem that speaks multiple languages and reaches every corner of the nation. Our digital interfaces are more than just interfaces; they are gateways to financial freedom, empowering customers to bank whenever and wherever they need to. Through internet banking, mobile banking, and phone banking, we offer round-the-clock access to a wide range of services, placing banking at our customers' fingertips

But we're not stopping there. Our digital banking is as much about convenience as it is about creating a safe, secure, and seamless banking experience. By automating processes, harnessing data analytics, and tailoring offerings to meet individual needs, we're redefining what it means to bank in the digital age.

Going beyond providing banking solutions, we are passionate and committed to giving back to the community that has supported us. Through our community outreach programmes and partnerships, we're trying to make a tangible difference in the lives of those around us, while fostering financial literacy and empowerment, every step of the way

To provide financial services to the un-served and the under-served customers as a responsible mass market bank, focussed on building a sustainable tomorrow.

- Customer's choice of institution

- Integrity in all dealings

- Provide responsible finance

- Fair with suppliers and service partners

- Professionalism and teamwork

- Respected in the community

- Compliance with laws, regulations and code of conduct

- Best place to work

CRISIL A1+

CERTIFICATE OF DEPOSIT PROGRAMME

CARE AA- Stable

SUBORDINATED NON-CONVERTIBLE DEBENTURES

CARE AA- Stable

LONG-TERM BANK FACILITIES

CARE AA- Stable

FIXED DEPOSIT

With a workforce of

22,566 employees,

we proudly serve over

86 Lakhs+ customers

The endurance of our relationship with our customers is evident when we say that two-thirds of our asset customers have been associated with us for three or more years.

DELIVERING SUSTAINED

VALUE CONSISTENTLY

We maintain a prudent mix of deposits, equity, loans, and investments, which facilitates sustainable growth and returns to our shareholders.

- Total Deposits: ₹ 31,462 Crores

- Advances: ₹ 29,780 Crores

- Shareholders’ Fund: ₹ 5,613 Crores

- Investments: ₹ 9,766 Crores

Our technology infrastructure, combined with our widespread network of branches, ATMs, and digital channels, ensures a smooth and seamless delivery of services to our valued customers.

- Creating a seamless service experience through a blend of physical and digital channels

- Utilising ATMs, and other touchpoints

- Implementing responsive and scalable cores and supporting IT systems

Bias for innovation and the development of products and services that offer superior banking experiences to our customers set us apart.

- Introducing innovative digital initiatives and systems

- Building and enhancing brand reputation

- Developing forward-thinking internal policies

- Establishing a robust risk management framework

- Streamlining processes through automation

We are dedicated to social empowerment and fostering banking and financial services accessible to all.

- CSR Expenditure: ₹ 6.34 Crores

- Aligned towards ESG

We take pride in our skilled and diverse workforce, bringing valuable experience and a range of expertise to our team.

- Employee Base: 22,566

- Women Employees: 4,410

- Average Training Hours: 35.27

- Employee Engagement Initiative

- Talent Management: 34 Hours/Employee Training

We are committed to minimising our impact on natural resources through our responsible operations and business practices.

- Total Energy Consumed: 73,115.49 GJ*

- Water Intensity per Crores Turnover: 25.69 GJ

- Natural Resource Conservation Initiatives

- 100% of the offices are replaced with energy efficient lighting systems

- New Infrastructure has been fitted with Sensor-based Taps

- 16.69 MT of Electronic Devices were disposed through Authorised Recyclers and 1.2 MT of the Electronic Devices were re-used, i.e., Donated Towards the Digital Literacy of the Government School Students

- Waste segregation at source, measurement, and responsible disposal of dry and wet wastes at corporate and all the regional offices

*gigajoule

- Growing reach

- Diversified product mix

- Robust digital backbone

- Well-equipped and energised team

- Strong positioning as a bank that positively impacts society

- Sound risk management

- Experienced leadership team

- Good governance

-

Total customers:

86+ Lakhs

-

Share of digital transactions in total transactions:

88.54%

-

Total income:

₹ 6,464 Crores

-

Dividend per share:

₹ 1.5

- Net Interest Income: ₹ 3,409 Crores

- Net Interest Margin: 9.1%

- Net Profit after Tax: ₹ 1,281 Crores

- Return on Assets: 3.5%

- Return on Equity: 26.1%

- EPS: ₹ 6.65 per share

- Capital Adequacy Ratio: 24.7%

- Gross NPA: 2.1%

- Net NPA: 0.3%

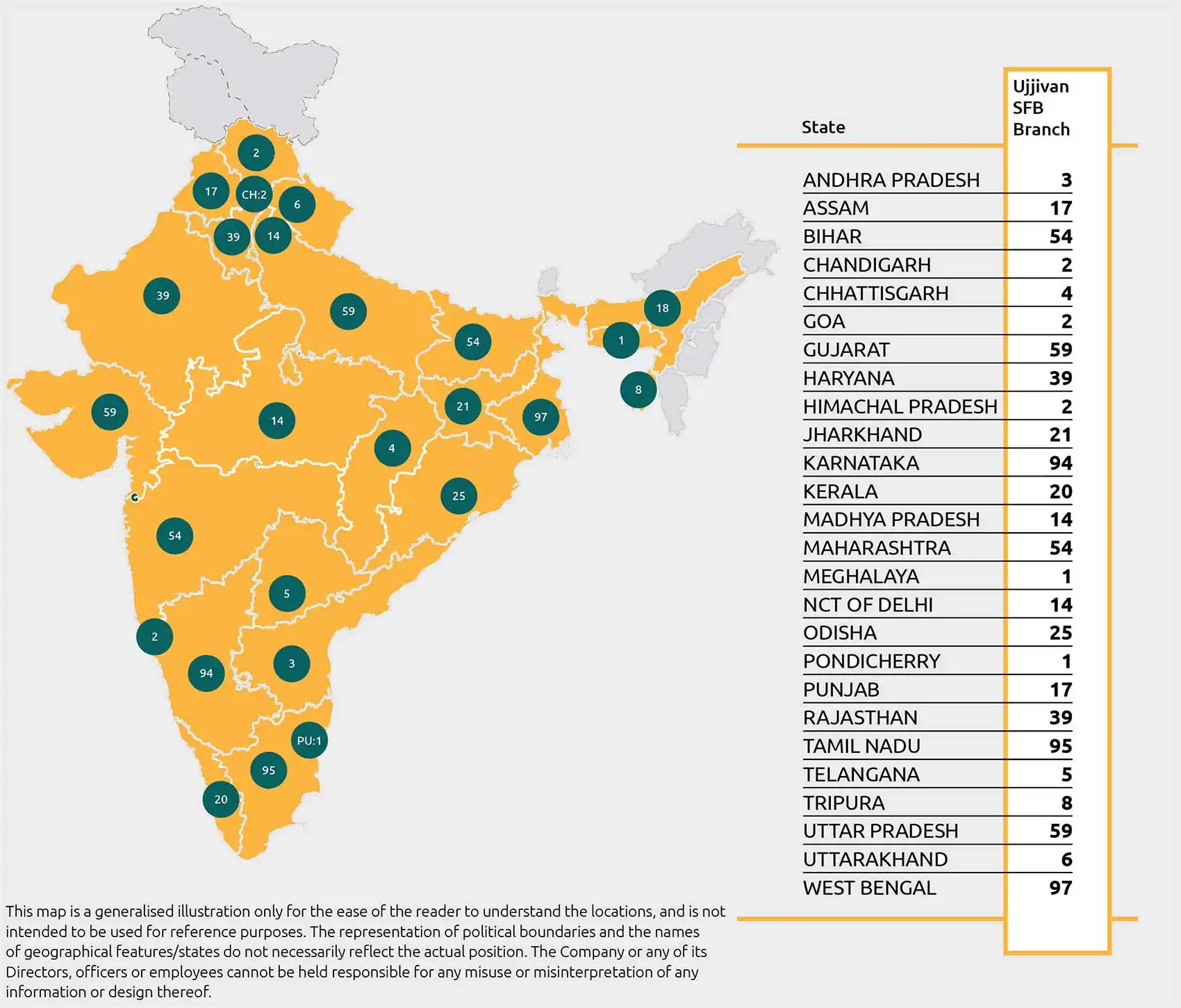

- Total Banking Outlets: 752

- Retail Asset Centres: 18

- ATM + Cash Withdrawal/Deposit Machines: 596

- Districts Covered: 326

- New States Added: 1

- Touchpoints Added in FY 2023-24: 1,000+

- 11.82 Lakhs Customers aquired through Digital Channels

- CSR Beneficiaries: 2.4 Lakhs+

- Women Empowered: 50,000+

- ESG Rating: CRISIL’s ‘Strong’ Rating on ESG & Leading ESG Champions of India by Dun & Bradstreet

- New Hires: 12,325

- Women in Workforce: 20%

- Employee Happiness Index: 90%

- Scope 1 Emission: 887.73 MT of CO2 Equivalent

- Scope 2 Emission: 13,995.74 MT of CO2 Equivalent

- Solar Energy Generated: 9.58 GJ*

- LED Light Implementation at Corporate and Branch Offices

- ESG Rating: CRISIL’s ‘Strong’ rating on ESG & Leading ESG champions of India” by Dun & Bradstreet

ENHANCING

PAN-INDIA PRESENCE

OUR MISSION IS TO EMPOWER THE UN-SERVED AND THE UNDER-SERVED COMMUNITIES, GUIDING OUR TRANSFORMATION INTO A MASS-MARKET BANK. WITH AN EXTENSIVE PRESENCE THROUGHOUT INDIA, INCLUDING ITS MOST REMOTE AREAS, WE HAVE BECOME A TRUSTED PROVIDER OF BANKING AND FINANCIAL SERVICES. OUR DIGITAL PLATFORM IS INSTRUMENTAL IN ENHANCING ACCESSIBILITY AND CONVENIENCE, ENSURING THAT OUR SERVICES ARE READILY AVAILABLE TO ALL.

CATERING

TO DIVERSE

BANKING NEEDS

IN OUR ENDEAVOUR TO CATER TO THE DIVERSE AND DYNAMIC NEEDS OF OUR CUSTOMERS, WE'VE CRAFTED A VERSATILE ARRAY OF PRODUCTS AND SERVICES. WITH A STURDY ASSET-LIABILITY FRANCHISE AND THE AVAILABILITY OF THIRD-PARTY PRODUCTS ACROSS MULTIPLE DELIVERY CHANNELS, WE ENSURE A SEAMLESS AND HASSLE-FREE BANKING EXPERIENCE. THIS MEETS OUR CUSTOMERS' FINANCIAL REQUIREMENTS WITH AGILITY AND ADDS A TOUCH OF CONVENIENCE TO THEIR BANKING JOURNEY.

Asset

₹ 20,690 Crores

Asset Book

47.12 Lakhs

Customer Base

₹ 1,414 Crores

Asset Book

9,445

Customer Base

₹ 4,924 Crores

Asset Book

48,949

Customer Base

₹ 1,731 Crores

Asset Book

48

Asset Customer Base

₹ 7,907 Crores

Liabilities Book

545

Liabilities Customer Base

₹ 175.83 Crores

Asset Book

34,777

Customer Base

₹ 86 Crores

Asset Book

1,510

Customer Base

Liability

₹ 31,462 Crores

Total Deposits

₹ 13,750 Crores

Retail TD

82 Lakhs+

Total Customer Base

₹ 8,335 Crores

CASA

₹ 9,256 Crores

Bulk TD

Third-Party Products

51.05 Lakhs

Lives Insured

28,000

Assets/Lives Secured

106,221

Lives Secured

INTEGRATING

GROWTH THROUGH

TECHNOLOGY

WE HAVE BUILT A ROBUST AND RELIABLE DIGITAL ECOSYSTEM DESIGNED TO SERVE DIVERSE CUSTOMER SEGMENTS WITH UNPARALLELED SPEED, PRECISION, AND SECURITY. OUR FORWARD-THINKING DIGITAL STRATEGY AIMS TO CRAFT A FUTURE-READY BANK, OFFERING CUSTOMERS SEAMLESS, OMNICHANNEL SOLUTIONS THAT ARE BOTH CONVENIENT AND AFFORDABLE. BY AUTOMATING THE MAJORITY OF OUR CURRENT BUSINESS PROCESSES, WE ARE PAVING THE WAY FOR ENHANCED EFFICIENCY AND CUSTOMER SATISFACTION.

Offer web-based platform(s) that can be accessed from any system

Provide high-volume bulk upload facility

Provide Aadhaar OTP authentication for setting and resetting passwords in personal net banking

Facilitate customisable client-centric approval matrix for business customers

141,450

Personal internet banking customers*

4,719

Business internet banking customers*

Available on Android and iOS operating systems

Available in 9 languages – English, Hindi, Kannada, Tamil, Bengali, Marathi, Gujarati, Punjabi, and Odiya

Provides Aadhaar OTP authentication for setting and resetting MPIN in mobile banking

2,160,642

Mobile banking application users*

First-of-its-kind voice and visual-assisted vernacular banking app

Available in the Android operating system with Voice Search and Voice Assistance

Available in 8 regional languages and English - Hindi, Marathi, Bengali, Tamil, Gujarati, Kannada, Oriya, and Assamese

Loan acknowledgement feature for Repeat & top-up Group Loan customers

QR Logistics Module in Finacle to indent and track Ujjivan pay QR indent, dispatch, and consumption for Money Mitra transactions.

550+ Money Mitra agents

Conversational AI call pilot for MicroBanking Savings Account customers with Awaaz.De

37%

GROUP LOAN CUSTOMERS ARE ACKNOWLEDGING THEIR NEW LOAN REQUESTS THROUGH HELLO UJJIVAN DIGITAL REPAYMENT

29%

PURE DIGITAL (CUSTOMERS PAYING DIGITALLY ON THEIR OWN THROUGH CHANNELS LIKE BBPS, SI, AND NACH)

10 Crores

DIGITAL REPAYMENT CUSTOMERS

4.23 Lakhs

ITD UJJIVAN PAY QRS DISTRIBUTED

₹ 682 Crores

ITD FUND FLOW

774,983+

‘HELLO UJJIVAN’ MOBILE BANKING APPLICATION USERS*

4.0/5.0

RATING ON THE GOOGLE PLAY STORE*

Our Phone Banking is unique in the industry as it provides access to customers in 8 Indian languages and English over IVR. Our phone bankers answer customer calls in 13 Indian languages 24/7

9 languages on IVR include Hindi, Kannada, Tamil, Bengali, Malayalam, Marathi, Gujarati, Punjabi and English. Additionally, 4 languages are supported through human interaction - Telugu, Odia, Assamese and Bhojpuri

Simple IVR with self-service options such as debit card hot listing, balance enquiry and mini statement options

Straight-Through-Process to fulfil select service requests with Debit Card authentication facility in IVR

78%

CUSTOMERS REGISTERED FOR ACCESS IN INDIAN LANGUAGES

200

IN-HOUSE PHONE BANKERS WITH UNITS IN BENGALURU AND PUNE TO SUPPORT AS BACKUP

19%

Customers Registered for Languages other than Hindi & English

450+

SERVICES COVERED UNDER PHONE BANKING AND VIDEO BANKING, WHICH INCLUDE QUERIES, REQUESTS AND COMPLAINTS

The unit answered 11.3 Lakh customer calls, which included queries, service requests, complaints, feedback and lead generation for new customers. 83% of total calls were answered within 15 seconds of agreed service levels and the unit’s uptime was 99.76%. Our Intrabank Service Index scores were at 81%.

ATMs & ACRs

Ujjivan SFB continues to maintain high uptime with state-of-the-art ATMs, fully compliant with all regulatory requirements. We are one of the few banks to have implemented cassette swapping at all ATMs and installed OTC locks to ensure both convenience and compliance. Ujjivan SFB enjoys a significant share in the ATM space at 19% among our peer group, boasting the highest growth rate of 3.3%. Ranking 29th among all banks, Ujjivan SFB has grown by 3.3% while the banking industry overall declined by 1% for total ATM transactions.

The Bank has significantly increased the number of touchpoints, currently operating 534 ATMs and 62 Auto Cash Recyclers (ACRs). Ujjivan SFB leads among all SFB banks in the volume of ATM transactions, with an impressive uptime of approximately 98%. To enhance customer experience, Ujjivan SFB has begun deploying state-of-the-art touch screen ATMs with multilingual screens. We continue to feature braille keypads for visually challenged customers. We also command about 41% of ATM transactions among our peer banks.

19%

MAJOR SHARE IN THE ATM AMONG PEER GROUPS

#29

AMONG ALL THE BANKS

Debit Card

Ujjivan SFB is making a significant contribution to digital transactions. We hold a market share of 21% in POS transactions and 14% in e-commerce transactions among our peer group. The Bank is the largest debit card issuer among our industry peers, with a card base totalling 10.26 Million users, and leads all SFBs in card transaction at POS. In FY 2023-24, debit cards accounted for over 46 Million transactions. While the industry grew by 1% in card issuance and the SFB industry by 2%, Ujjivan SFB achieved a growth rate of 3%. Additionally, the Bank increased its transaction touchpoints through ATMs, ACRs, and Money Mitra, along with other digital initiatives, thereby enhancing the phygital presence.

1st

AMONG ALL SFBS IN CONTRIBUTION TO CARD USAGE

1st

AMONG ALL SFBS IN CARD ISSUANCE

10.26 Million

CARD BASE

46 Million

CARD TRANSACTIONS

UJJIVAN SFB CARDS CAN TRANSACT

2 Lakhs+ ATMs

ALONG WITH 50 MILLION MERCHANT POINTS

In FY 2023-24, Phone Banking came out strongly by realigning and building a new road map for the Bank’s strategy. Constant engagement with different businesses and functions of the Bank led to progressive service standards, the introduction of customer-centric channels such as Video Banking, Virtual Relationship Manager, and a dedicated/expert team called DigiMitra for customer support

Virtual Relationship Managers: for sales, service, and relationship management

Video Bankers: to facilitate service requests and Digital Customer Acquisition

DigiMitra: a Subject Matter Expert handling their queries in using our digital channels

Specialised Outbound Team: to manage sales and service-related campaigns

Inbound Channel: to operate 24/7 for supporting customers

Safe and Convenient Banking

The concept of ‘straight-through processes’ enabled our customers to carry out critical account-related transactions over a call. Services such as freezing of accounts, blocking and unblocking of UPI services, stopping payment of cheques, enabling and disabling of internet banking, registering and disabling of mobile banking, hot listing of a debit card, and changing e-mail ID and mobile numbers were offered through Phone Banking even during non-banking hours and holidays. This resulted in a reduction in TAT and ease of access to our customers. Providing end-to-end services such as account change requests, obtaining consent for arbitration from customers, and approval of deliverable requests through Phone Banking and Aadhaar seeding confirmation over phone calls have further provided ease of convenience to our customers.

76%

'FIRST CALL RESOLUTION' THROUGH ‘STRAIGHT THROUGH PROCESSES’ RATE ACHIEVED, PROVIDING CUSTOMERS WITH HIGH SATISFACTION WHEN BANKING WITH US

Contributing to Business

All efforts are made at Phone Banking to support business teams and value generation for the Bank by sourcing all products (Assets and Liabilities) through our Inbound and Outbound channels. An average of 10,400 leads are generated per month, which further led to an outcome of average value of ₹ 40 Crores month-on-month, moving us to a total of ₹ 480 Crores in total for FY 2023-24. The conversion rate stood at 18%. Phone Banking team books deposits, on call for existing customers. 720 Term Deposits valued at ₹ 2.50 Crores were booked through calls during FY 2023-24.

Video Banking

We launched Video Banking channel to offer branch-like experience to customers. This facility is accessible in multiple languages by providing seamless banking services through branchless solutions. It brings ease of access and convenience with robust multi-layer authentication for security. Our Video Banking channel is now capable of handling service requests of customers which require submission of documents and/or authorisation, such as requests related to VKYC/Re-KYC, address change, profile updation, signature updation, PAN updation, submission of Form 15G/H, Aadhaar seeding for DBT, activation of dormant account, and account upgrade/transfer services among others. These usually required customer visits to branches earlier, but now an alternative channel has been made available. Our Video KYC services have a huge potential for the acquisition of retail deposit customers digitally from even in geographical locations where the Bank does not have branches.

₹ 47.83 Crores

Digital Savings Account & Digital FDs Value Acquired for New Customers through VKYC for the Year

3,836

Digital Savings Account & Digital FDs for New Customers through VKYC during the Year

FOSTERING A

SUSTAINABLE

BRAND

AT UJJIVAN SFB, OUR COMMITMENT ENCOMPASSES A COMPREHENSIVE APPROACH TO BRAND BUILDING, ONE ROOTED IN RIGOROUS RESEARCH AND STRATEGIC INSIGHT. WE UNDERSTAND THAT ESTABLISHING A STRONG BRAND PRESENCE REQUIRES A MULTIFACETED STRATEGY THAT REACHES AUDIENCES THROUGH VARIOUS CHANNELS. ACROSS ABOVE-THE-LINE (ATL), BELOW-THE-LINE (BTL), DIGITAL, AND SPONSORSHIP CHANNELS, WE EMPLOY A RESEARCH-DRIVEN APPROACH TO OUR BRAND-BUILDING ACTIVITIES. THROUGH OUR INTEGRATED APPROACH TO BRAND BUILDING, WE AIM TO CREATE A LASTING IMPRESSION ON OUR AUDIENCE, FOSTER BRAND LOYALTY, AND, ULTIMATELY, MAKE A MEANINGFUL IMPACT.

A Transformative Journey of Trust and Progress

Why Trust Matters...

Trust is crucial in banking relationships. More than just numbers, it's the foundation: In the fast-paced world of finance, where banking can feel mechanical, Ujjivan SFB aimed to bring a touch of warmth to the existing ecosystem. We realised that banking is about more than just money; it's about enabling you to safeguard your dreams and aspirations, financially. Our brand campaign, ‘Ek Doosre Pe Bharosa, Ek Doosre Ki Tarakki’ (Mutual Trust. Mutual Progress.), wasn't just advertising; it was a clarion call to invest and build trust in each other.

This belief was reflected in every communication we undertook. From festive promotions on occasions like Diwali, Durga Puja, Ganesh Chaturthi, and Navratri, to designing diary and calendar themes, the communication reflected the ethos of 'Trust and Progress'.

Customer Engagement

Beyond festivals, we also leveraged thematic days such as Teachers' Day, Mother's Day, World Environment Day, Independence Day, and Republic Day, among others, to connect with customers and promote our products and services. In India, cricket is the heartbeat of the nation. So, we capitalised on the Women's IPL matches in March–April 2023 by promoting our Fixed Deposit interest rates on the Jio OTT channel.

The overall campaign was well received which was reflected in higher brand recall in our post-campaign evaluation survey.

We welcomed the NRIs with our campaign ‘Welcome Home to Higher Returns’ in select markets across high customer touch points.

We launched special campaigns for the Affordable Housing Loan as well. The Monsoon campaign in July–August 2023 on Home Improvement Loan and the Grihapravesh digital campaign in March was also well received by the customers.

Out of the Box Initiative

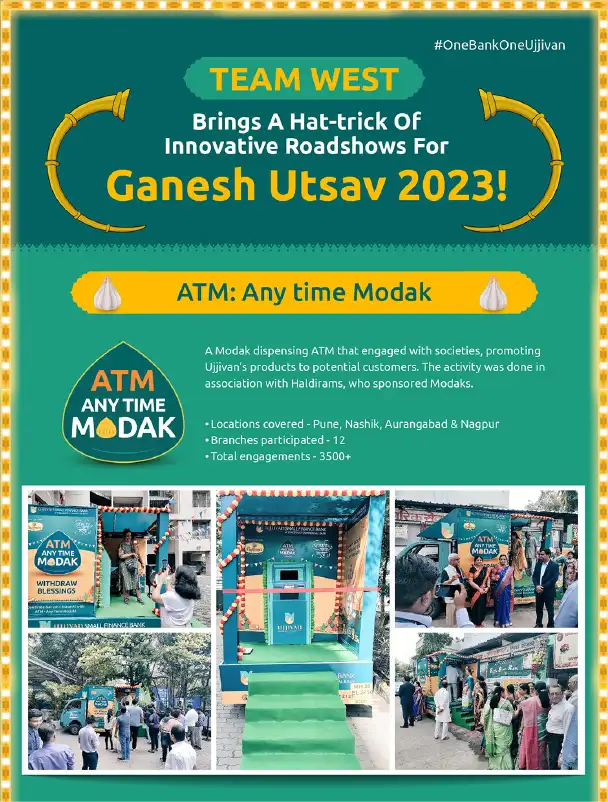

Ganesh Chaturthi

We orchestrated a vibrant campaign to showcase our banking products and services. Utilising innovative technologies like motion sensors and sound frequencies, we curated memorable experiences for our target audience. Our unique experiential marketing initiatives included:

- AnyTimeModak: A modak dispenser ATM on wheels

- ECO Phool Pandal: Promoting recycling with a live demo of Nirmalya recycling

- Band Baja Bappa: An engaging experience with sound sensors coupled with the launch of our Maxima product

The Band Baja Bappa campaign garnered widespread attention and acclaim, earning us a State-Level Maharashtra Radiance Award. Through road shows across Maharashtra and strategic radio partnerships, we reached millions, leaving a lasting impression on the community.

Onam

Onam, a festival larger than life for Keralites celebrates unity, family, and tradition through the vibrant art of Pookolam. Leveraging this cherished tradition, we set out to make history. Our innovation? Crafting the largest Pookolam ever seen, integrating the Kerala map and cultural symbols of Onam. But the pinnacle of our achievement was securing a World Record for the largest Pookalam. This certification was accorded by the World Book of Records, a testament to our dedication and creativity, forever etched in the annals of history.

New Launches

Our growth is reflected in our dedication to serving customers. The addition of the Vijayawada branch in Andhra Pradesh seamlessly aligns with our vision for inclusive growth. Our first branch in Andhra Pradesh is a testament to our continuous efforts to connect with diverse communities. With 752 branches in 26 states and UTs (as of March 2024), we are making banking accessible to more communities and marching towards fostering financial growth across the country.

In August 2023, we proudly introduced our latest product, 'Maxima Savings Account’, & ‘Maxima Current Account’ tailored exclusively for our premium customers. Maxima products represent our commitment to delivering exceptional quality and tailored solutions to meet the unique needs of our esteemed customers. It embodies cutting-edge features to elevate the experience for our customers. We used airports and malls to reach out to our customer segments and ensure business generation.

Digital Initiatives

The world is changing, and so is Ujjivan SFB. Our recent digital transformation makes saving and managing money easier than ever. Customers can open a savings account and fixed deposit account anytime, anywhere, with the user-friendly online platform. The revamped website facilitates effective communication through a more simple and intuitive navigation. Leveraging mailers, SMS, and push notifications, we proactively reach out to existing customers and target audiences, keeping them informed about our offerings and ensuring a more personalised and accessible banking experience.

Recognised for Our Marketing Excellence

- Effie Awards India: Shagun ka Lifafa Campaign

- Pitch BFSI Marketing Awards Silver: for the Most Effective Regional Campaign for Branch Launch Communication

- Pitch BFSI Marketing Awards Bronze: for the Fixed Deposit Campaign done on Independence Day

- Eggfirst Chalo Rural Conclave & Awards for the Postman activity in rural India

- ACEF Global Customer Engagement Awards for the Word-of-Mouth Marketing initiative for Mother's Day

- Maharashtra Radiance Award for Ganesh Chathurthi Campaign in Maharashtra

- Entered the ‘World Book of Records’ for the Largest Cultural Kerala Map Flower Carpet (Pookalam)

The Next Mile

In an era, where digital innovation drives transformative change, we are committed to harnessing the power of technology to enhance the banking experience for our customers. Along with our branch, we aim to further leverage digital solutions to provide seamless and convenient banking services. This includes expanding our online platform to offer a wider range of services, ensuring that customers can access banking facilities anytime, anywhere.

SOCIAL

BUZZ

@UJJIVAN_SFB

@UJJIVAN_UNIVERSE