As one of the leading small finance banks in India with a clear focus on serving the under-served, the affordable housing segment is a key vertical for us. Our clients mostly seek loans for EWS, LIG or MIG housing in cities and semi-urban areas, and work in the formal or informal sectors. We also help to intermediate the government’s social priority of providing housing for all, and have helped more than 4,400 customers secure a subsidy under the Pradhan Mantri Awas Yojana (PMAY-CLSS) scheme.

Our affordable home loan products target aspiring homeowners, who may or may not have regular monthly sources of income, and dream of buying or constructing their own homes. Many of them are also eligible for subsidy under the PMAYCLSS scheme, and we help to facilitate the receipt of subsidy, and provide a loan for their remaining home financing needs. In this way, we function as a one-stop-shop for the PMAY-CLSS eligible category of homeowners, and the synergies help us to grow our market.

Quick facts

Total Disbursement

60% Increase y-o-y

Collection Efficiency

Gross Loan Book

33% Increase y-o-y

Total Borrower Base

26% Increase y-o-y

Profitability, productivity and portfolio quality are the three dominant levers that drive our performance. Over the year, the affordable housing business vertical has grown by 33.42%, with ₹1064 Crores being disbursed in FY 2021-22. Our total loan portfolio has crossed the ₹2700 Crores milestone, and our total home loan customer base is upwards of 30,000. Though the first half of the fiscal was subdued due to the pandemic, and COVID 19-related restrictions on movement, business picked up fast from the third quarter onwards, and we were able to close the fiscal on a strong note.

The pandemic impact during the first and second quarters stressed our loan exposure. In response, we eased the payments process by fully digitising the mode of NACH registration and simultaneously increased focus on collections through active tracking of delayed, and defaulting payments. Our team also managed to restructure debt profiles by dexterously using the one-time restructuring and Mortgage Reference Rate margins. Product and credit teams successfully implemented the Centralized Credit Processing Unit to underwrite bank credit salaried

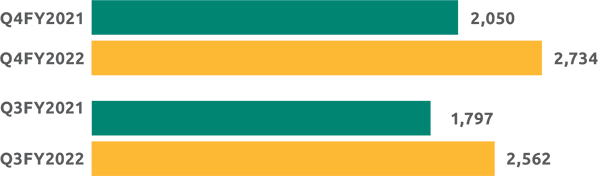

Disbursement Growth (` Cr)

OSP (` Cr)

profile applications, and this led to reduction in income sanction TATs. Measures like these helped to increase our loan disbursement rates and inward receipts. We also took pertinent measures to increase the pace of customer acquisition and loan sanctioning. Seamless onboarding of thirdparty vendors was enabled through digital signing and stamping platforms. Further, in-house digital and analytics tools are being used to leverage the existing customer base, to facilitate up-sell and crosssell among them.

Our topmost priority remains providing the best-in-class service to our customers through our dedicated and skilled workforce, for there is no better brand ambassador than a satisfied customer. In the future, digitisation will increasingly transform several aspects of customer interaction, with functions like digital customer onboarding, underwriting, and e-customer service, becoming common.

The key priorities for Affordable Housing Loan business include Channel & geographic diversification, product customization, digitization and nurturing manpower for business growth & stability. Product customization with state/location specific policy mainly to cater to the demand in tier 2 & 3 locations across various income segments should go a long way riding on a multi-channel sourcing platform. Digitizing the process completely will give further impetus to the effort, both for process efficiency and customer service. Manpower management is a critical element and a focused approach has been adopted to groom ‘Leaders for Tomorrow’ through a ‘Leadership Development Program."

Pradeep B

Business Head - Housing Loans

Outlook

Going forward, we will continue to grow our retail business with deeper penetration in Tier-2 and 3 markets. We aim to create a significant presence of the Affordable Housing segment in the Ujjivan SFB ecosystem, with above 75% reach across our branch network. We will sharpen our focus on leveraging our existing to bank (ETB) customer base with insights from in-house analytics. We will also launch specific offerings targeted at rural borrowers in select markets, starting with South India, besides collaborating with government bodies to concentrate on ready-to-move-in builder projects in the semi-formal income space.

Collections are showing an upward trend and will continue to get better. Usage of legal tools on collection will improve efficiency further as we grow our portfolio, reduce the Gross Non-Performing Asset (GNPA) and maximise the use of digital workflows.